So, you're ready to dive into the world of trading! 🚀 Awesome! 🎉 But with options like day trading, swing trading, and long-term investing, where do you even begin? 🤔

Each style has its own rhythm: 🎶

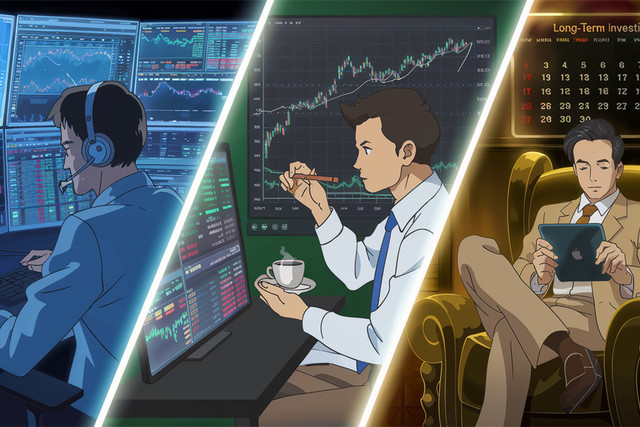

- Day Trading (Scalping): 🏎️💨 Fast-paced, high-risk, high-reward. Requires constant attention 👀 and nerves of steel. 🥶

- Swing Trading (Intraday): 🏄♂️🌊 Mid-term holds, capturing short-term trends. Less intense than day trading, but still demands active monitoring. 🧐

- Long-Term Investing (Position): 🐢🌳 Buy and hold for years, riding the market's ups and downs. 🎢 Patience is key! 🧘♀️

Picking the wrong style can lead to frustration 😫, losses 💸, and maybe even quitting altogether. 💔

Ask yourself: 🤔

- How much time can you dedicate? ⏰ Day trading is a full-time job. 💼 Swing trading requires regular check-ins. 🗓️ Long-term investing is hands-off. 😴

- What's your risk tolerance? 🎢 Day trading is the riskiest. 🚨 Long-term investing is the most conservative. 🛡️

- What are your financial goals? 🎯 Quick gains? 💰 Steady growth? 🌱 Retirement savings? 👴👵